Recently, there’s been a lot of buzz about how product-led growth (PLG) is changing sales tooling. For example,1 here’s a tweet on the topic:

Astasia Myers of Redpoint Ventures wrote an article deep-diving into the topic. Sam Richard from OpenView Partners, the firm that coined the term “product-led growth,” also posts about the topic.

What is a PLG CRM?

Broadly speaking, PLG CRM is a tool that allows Sales teams to handle thousands or even millions of users as easily as managing a few key accounts. It enables data-driven sales decisions.

Such a CRM might take into account how often a user interacts with the product to identify power users or champions. It might predict who’s likely to convert from the free to paid based on a set of behaviors that aren’t obvious to the seller (e.g., uploading 5 files to a file-sharing product within a 7-day period). Other features may include the ability to track users over the customer journey, segment users finely, and identify key moments where an interaction with a rep can prevent churn or enable conversion.

On top of that, a PLG CRM could automate workflows by integrating with the plethora of tools in the GTM stack—Slack, marketing automation platforms, in-app messengers, and support tools to name a few.

Do we really need yet another sales tool? Here’s why we think so.

3 reasons PLG CRM is having a moment

Product-Led Growth is at an inflection point

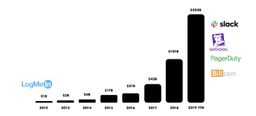

Most SaaS companies today are considering adopting some form of a product-led motion. How big of a trend is that, exactly? The combined market cap of public PLG companies gives us a sense:

It’s not limited to the US, either. The most widely used enterprise software products in China leverage some form of PLG. As traditional outbound and inbound channels become fiercely competitive—driving cost of customer acquisition (CAC) up—PLG offers the allure of low-cost organic growth. Lastly, investors love PLG too, as they tend to result in higher net revenue retention, stronger margins, and faster growth rates—key ingredients of high trading multiples.

Existing tools are not doing the job

What’s wrong with the existing CRM and sales tooling, you might ask? We think the problem is three-fold:

1. They are not designed for handling user-scale amounts of data

Incumbent sales tools were developed 10+ years ago when the sellers focused on tracking a handful of large accounts. Over-time, companies build pipes to push more data into CRMs, e.g., Marketo integrations with Salesforce. However, handling hundreds of thousands of rows of users feels awkward and cumbersome in them—let alone the increased storage costs. Loading dashboards and reports can take minutes.

These tools also have limited functionality to pivot, sort, and transform data. We know many sellers who would export data into a CSV to then analyze it. All this to support simple analyses such as identifying which accounts are growing in usage month over month. Not a very satisfying experience.

2. Solving these problems with the existing stack requires cobbling together of disparate applications

There is nothing built with the workflow of a data-driven sales rep in mind. Most companies wanting to leverage customer data to inform their sales decisions end up building hacky internal tools.

They ask a data scientist to sort through the data collected in Segment or a data warehouse and build metrics that the sales team can act on. For example, the sales team might want to know the number of active users within an account out of the number of total seats in the past 30 days. Following that, the data team or a savvy Sales Ops analyst needs to set up a reverse ETL tool such as Census to pipe that metric into Salesforce. Then, a data analyst might build a dashboard in Looker to provide additional views on top of the data for the seller. The seller would, of course, have to toggle between multiples tabs to use that dashboard.

Evidently, there are many problems here ranging from the use of scarce engineering and data science resources—typically constrained for startups trying to find product-market fit—to the sub-optimal end user experience for the seller.

3. Existing tools lack predictive and proactive capabilities

Most sales teams we speak to count themselves lucky if they had any internal tool to use. The bar today is set pretty low. As a result, most internal tooling built for PLG sales is not predictive. They rely on straightforward metrics such as time spent in app to score leads, and depend on Sales Ops to manually decide which behaviors indicate likelihood to convert. “There is an opportunity to build an intelligent product that recommends the right ‘playbook’ for each customer depending on their profile”, said the revenue of a top product-led SaaS company we talked to.

Many sales people also do not want to have to check these internal dashboards on regular basis. A PLG CRM could push notifications to sellers instead, so that they can reach out to high intent customers at the exact moment where they are most inclined to convert. On top of that, existing CRMs are not typically real-time, which fails for just-in-time interventions. For example, you wouldn’t be able to call a customer to drive an upsell the moment they start exploring premium features—you’d have to wait a day or two.

The modern data stack makes it all possible

Almost every tech company is now running on the cloud, and storing data in cloud data warehouses. Snowflake has become a $60B behemoth, making it easy to forget that it only launched 6 years ago. By centralizing data from billing systems, CRMs, product analytics, and other demographic sources in the cloud data warehouse, the PLG CRM can read directly from this single source of truth.

Product analytics like Amplitude make it easier to collect data. ETL tools like Fivetran can move data into the data warehouse, where it is transformed by dbt. Reverse ETL tools then can push the data back into the PLG CRM, and also connect that CRM with other sales tools like Intercom.

With the groundwork laid by data infrastructure companies, building data-driven sales tools has become a lot easier.

What’s next for the CRM

While the tailwinds are strong, it’s not all diamonds and roses. There are reasons why the CRM hasn’t been reinvented. These range from the dominance of existing players to issues dealing with disparate data sources or mapping customer records across systems—CRM, product, billing, support, and more. But that’s a topic for another day.

At HeadsUp, we believe that the way revenue teams work is changing, and that the tools they use need to be reinvented. It seems a fair number of people agree with us, given the number of founders building in this space and the spread of investors backing these companies. No matter who defines this category, what is clear is that it has massive potential to improve the experience of both sales and customers. It is an exciting time to be building for the next generation of enterprise companies.