Lenny’s Newsletter published an excellent survey of how the go-to-market strategy of B2B SaaS companies evolved over time. By speaking to operators at companies ranging from upstarts like Notion and Retool, to giants like Stripe and Salesforce, we got a glimpse into how the go-to-market strategy changed as the companies grew.

The survey covered 30 of the most high-performing B2B SaaS companies (full list below). Some fascinating, and at times counter-intuitive trends emerged from this deep-dive.

In this article, we present a data-driven analysis of the results from Lenny’s survey, with our takeaways.

If you want to get more industry analyses and insights like these in your inbox, once a week, subscribe to our Product-Led Sales blog.

Overall takeaways

The data showed a few things clearly.

First, you have to layer on sales, even though being product-led early on might help you grow quickly. You might even want to transition from product-led to predominantly sales-led, such as companies like Front and Intercom.

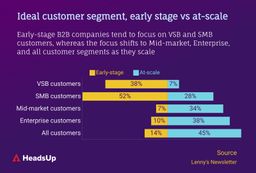

Second, you have to start off targeting startups, but you also must move upmarket to grow. In fact, most companies either focus on mid-market and enterprise, or serve all customer segments, by the time they reach scale.

Finally, you should focus on selling to a few personas when you are early-stage. For example, Coda focused on Product Managers in the Bay Area when it started out. However, by the growth stage, most companies were selling products with multiple use cases targeted at different personas.

Transitioning away from a product-led go to market strategy

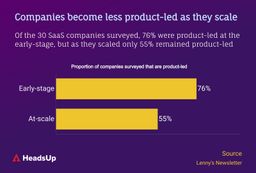

Although product-led growth is all the rage, at some point pure PLG taps out. To truly go wall-to-wall in the enterprise, you have to layer on sales. For more on this topic, check out this article on when is the right time to layer on sales.

Interestingly, this chart shows that even when we account for companies using a product-led with sales assist motion, the number of companies with any kind of product-led motion falls. In other words, some companies are abandoning PLG altogether as they scale.

Why is this the case?

First, many companies move upmarket. When the deals you focus on change from $1000 to $100,000, suddenly product-led growth makes much less sense. Rarely will anyone buy a $100k product without talking to sales.

Second, as products increase in complexity, they become harder to onboard. You want to put customers in a sales-led flow so that you can make sure they see the value. Customers need to be taught how to use your product properly, otherwise, they might find it confusing and churn.

Deep dive into the evolution of GTM motions

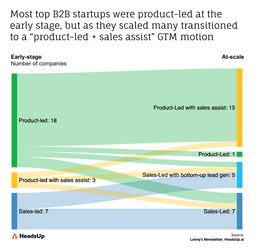

We see here that of the 18 companies that started off product-led, 14 added a sales assist motion. There were even 2 that transitioned from purely product-led to purely sales-led! (Front and Intercom)

Similarly, if you are sales-led, you might want to start a bottoms-up motion to help with lead gen. If individuals within an organization can try your product, they are more likely to become champions and drive word-of-mouth growth throughout their companies. Amplitude, Hubspot, and Salesforce all adopted this strategy.

Interestingly, the only company that stayed purely product-led (without even sales-assist!) was Gusto. This is probably because their product is a SMB Payroll and HR system. Moving upmarket requires changing the product considerably, and there are established incumbents like Workday to contend with. Since Gusto’s ACV ranges from $480 to $1800, layering on sales does not make sense for its unit economics.

Moving upmarket

B2B SaaS startups love to start off selling to startups. Just ask Brex. Startups are more willingly to adopt new, untested products, and also have fast sales cycles that allow you to quickly test your product and learn from the market.

However, once you scale past ~$50m ARR, you’ll find the Very Small Business (VSB) and Small and Medium Business (SMB) market starting to tap out. Intuit is probably the only company to reach $100b+ in market cap while focusing mainly on SMBs. To become really big, you have to also sell to the enterprise.

In fact, we see that most SaaS companies end up selling to all customer segments by the time they become a large company. Salesforce is a classic example – everyone from tiny startups to Fortune 500 enterprises is on their product.

To read more about these companies, how they thought about GTM, and the quotes from their GTM operators, check out Lenny’s superb piece here. (You should also subscribe to his newsletter!)

Here’s are the companies that were included in the survey: